Unfortunately, in the stampede for yield, investors in dividend stocks are overlooking the single most critical fact: valuations for the 'bluest of blue chip' dividend stocks, as measured by the Dow Jones Select Dividend Index, are now higher in aggregate than valuations for the broader market.

This must represent a profound source of consternation for traditional value investors, who must be enormously frustrated that their value bias can no longer be reconciled with a dividend focus.

Chart 1. Price to Book Discount of Dow Jones Select Dividend Index vs. Russell 1000

Source: Bloomberg

Chart 2. Price to Earnings Discount of Dow Jones Select Dividend Index vs. Russell 1000

Source: Bloomberg

You can see that based on both PE ratio and PB ratio that dividend stocks are valued at or near a premium to the broader stock market. Further, looking back to 2003 (the inception of the dividend index), dividend stocks have rarely been more expensive relative to the broader market.

Readers of this blog won't be surprised to learn that we would advocate for investors to replace their thirst for yield with a thirst for low volatility. The following charts make the case.

Chart 3. Low volatility stocks outperform the market in absolute and relative terms

Source: Deutsche BankChart 4. Low volatility stocks are substantially cheaper than dividend stocks

Source: Yahoo finance

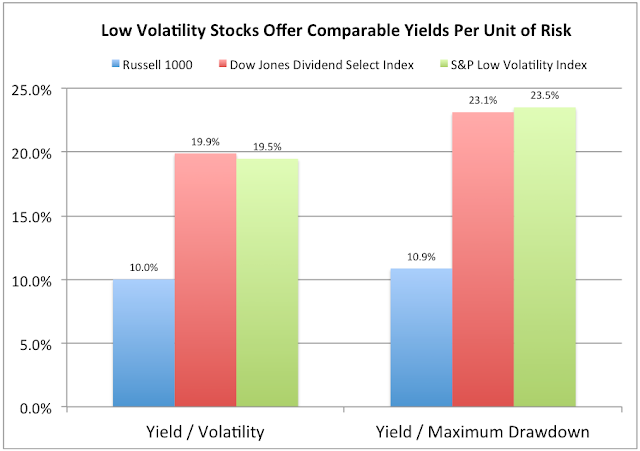

Chart 5. When yields are adjusted for risk, rational investors would be agnostic about investing in low volatility versus high dividend stocks, but would prefer either to the market index

Source: Yahoo finance

Chart 6. Last but not least, low volatility stocks in aggregate are under-owned - in stark contrast to the extremely over-owned dividend sectors.

Source: Deutsche Bank